Casual Info About How To Sell Short Stock

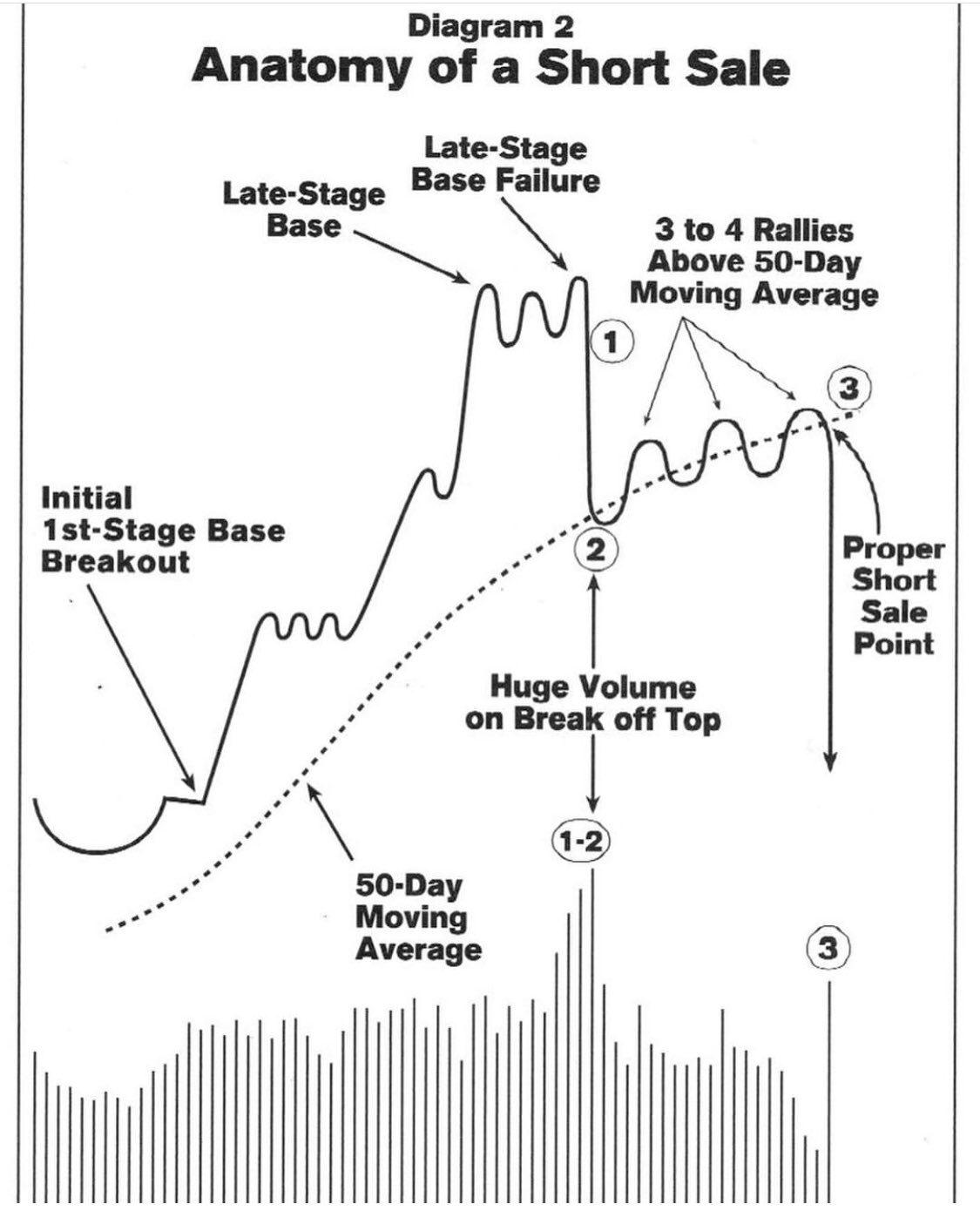

When you enter buy order you are closing your short position and buying the shares back from the stock market so.

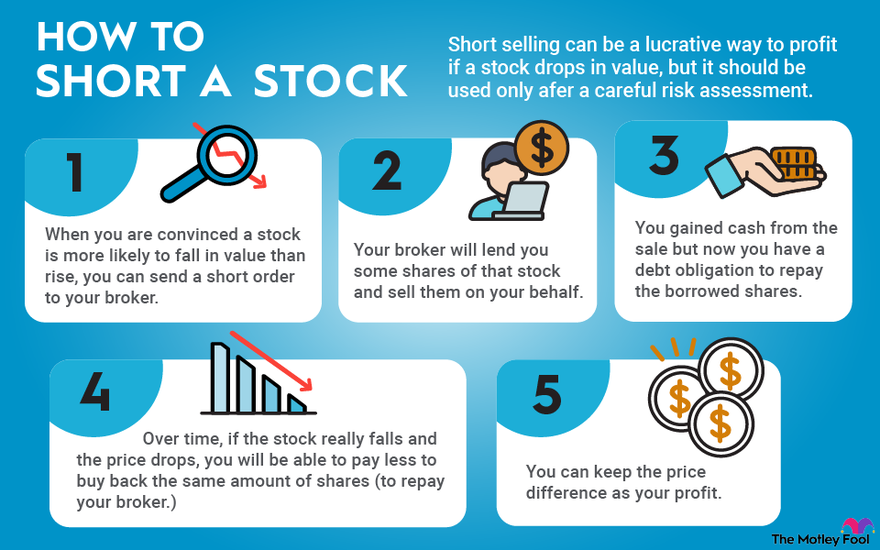

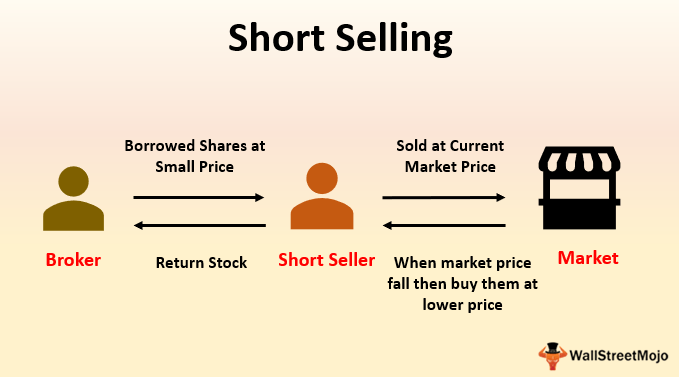

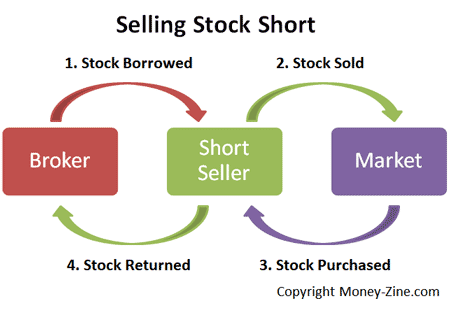

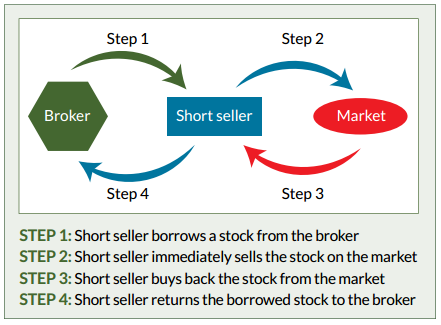

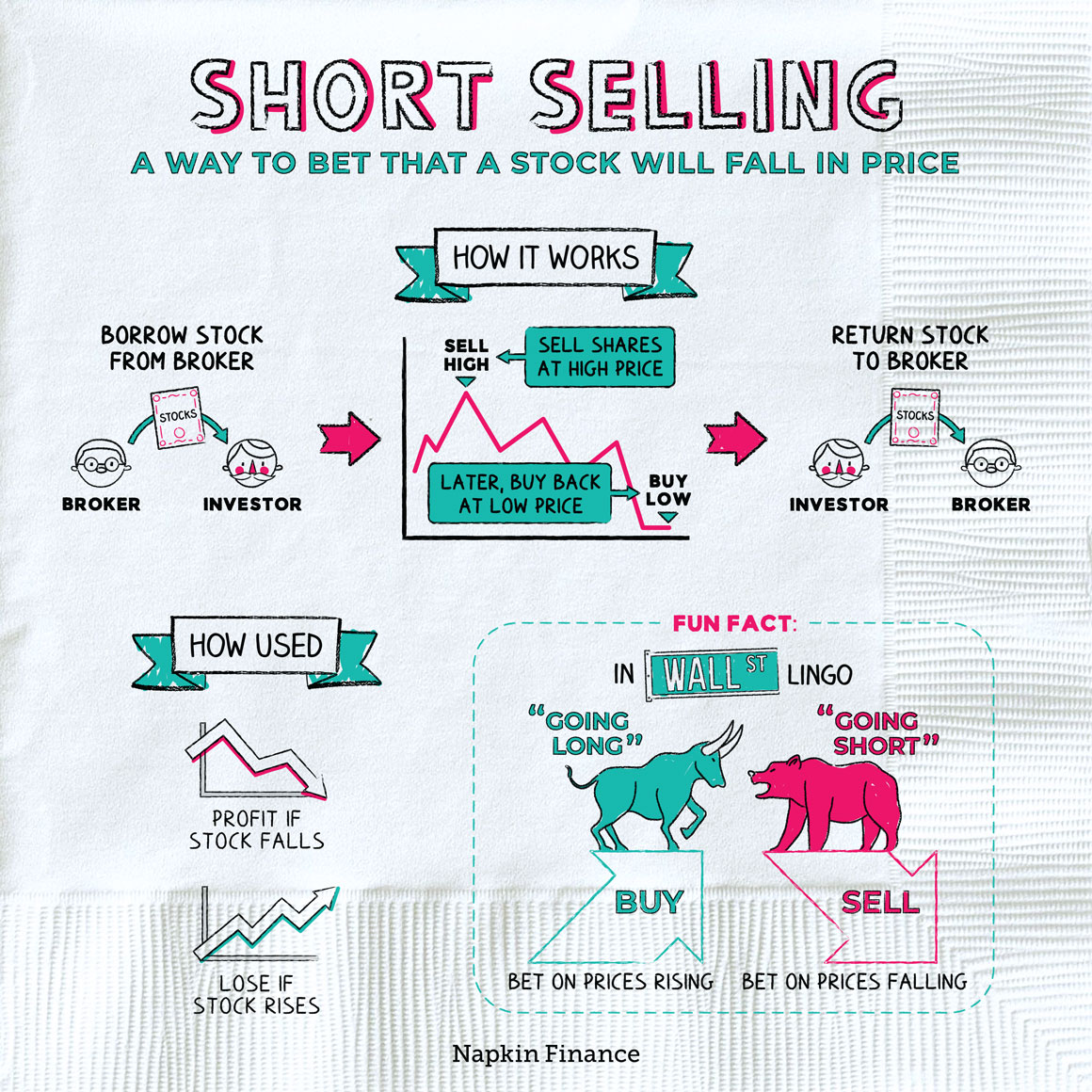

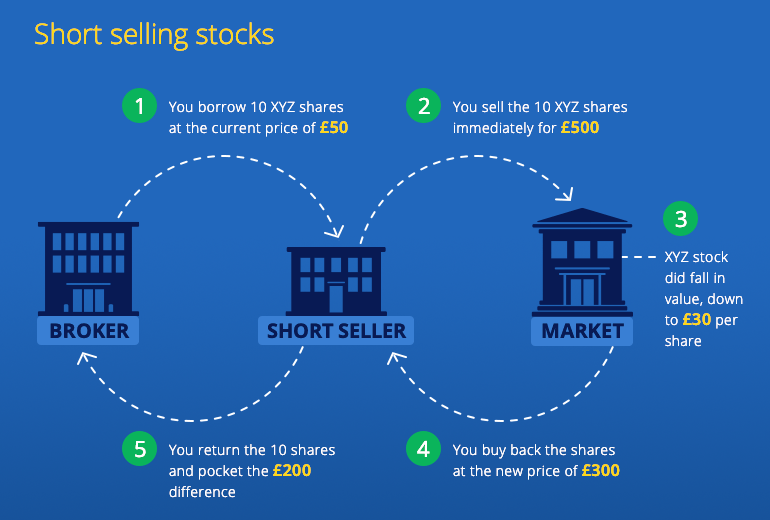

How to sell short stock. Short sellers are wagering that the stock they are short selling will drop in price. When you want to sell short, in order to get the shares to sell, you borrow them from your broker. These are the six steps to sell a stock short:

Now wills has put some prices around our stock picks. To short a stock, a trader initiates a position by first borrowing shares from a broker before immediately selling that position in the market to other buyers. How to short sell stocks.

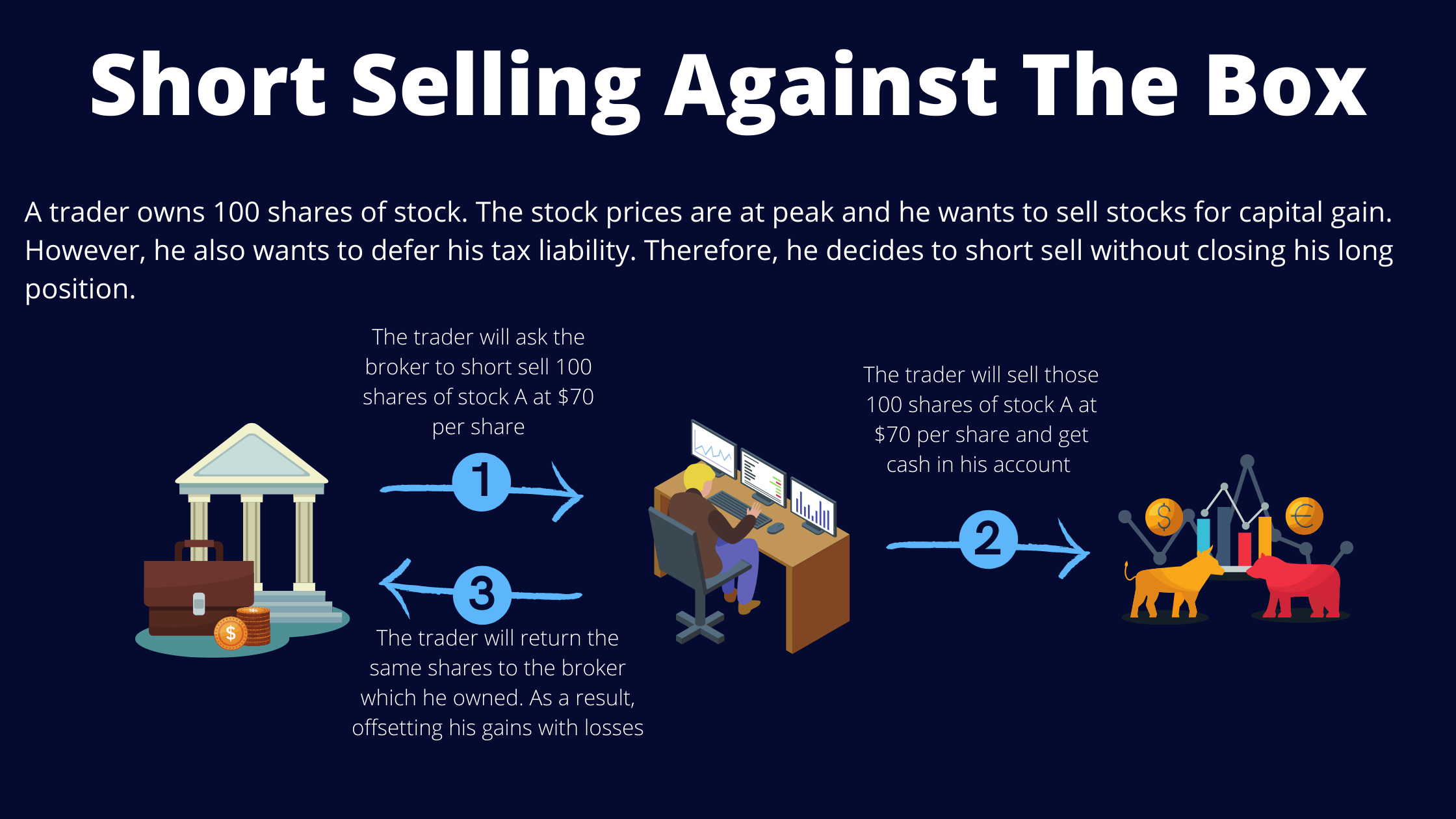

When you are selling shares, you have to take it from someone who owns it. Basically, short selling is when you sell a trade, and then expect the price to fall and. Choose the stock you believe will decline in value.

A short position is generally the sale of a stock you do not own.investors who sell short believe the price of the stock will decrease in value. Short selling is the sale of a security that is not owned by the seller, in the hope that the price will fall so that it can be bought back at a lower price to. At the end of june 2021, the share prices are csl at $285,.

The process of short selling is relatively simple once you've identified the stock you want to short. To short a stock, you’ll place an order to sell stock that you don’t own. Understanding how shorting works is key for your desired outcome.

If the stock does drop after selling, the short seller buys it back at a lower price and returns it to the. To short a stock, you need capital. How does a short sale work?

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_shortselling_FINAL-781cdf1e97ab4425939eb109b666a004.png)