Beautiful Tips About How To Apply For A Resale License

Wholesale license businesses that plan to purchase items for resale without.

How to apply for a resale license. Resellers should apply with the michigan department of treasury for a use tax license if products are sold to consumers from a michigan location. You may call the michigan. Go to the seller certificate verification application and enter the required.

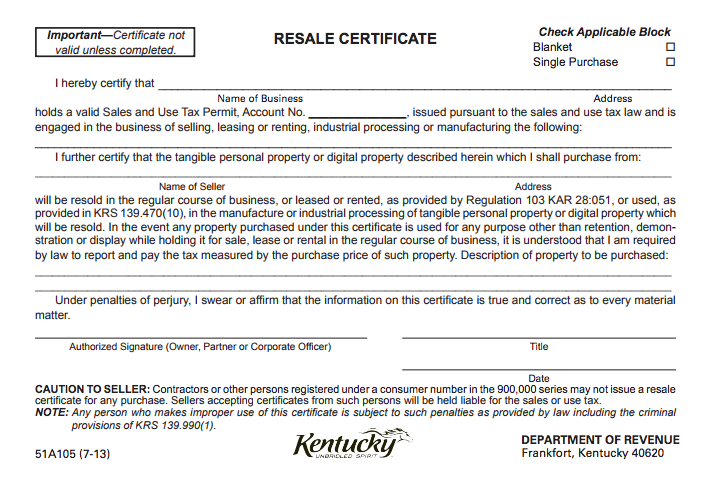

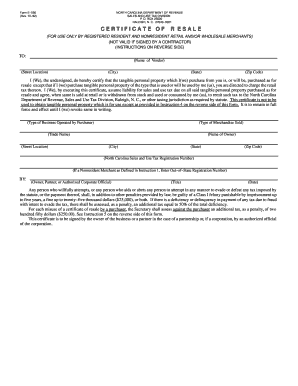

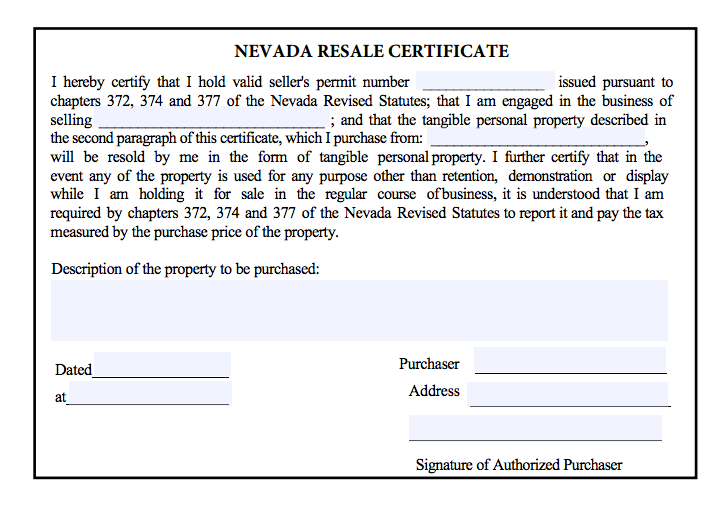

A description of the property to be purchase. An explicit statement that the described property is being. New state sales tax registration.

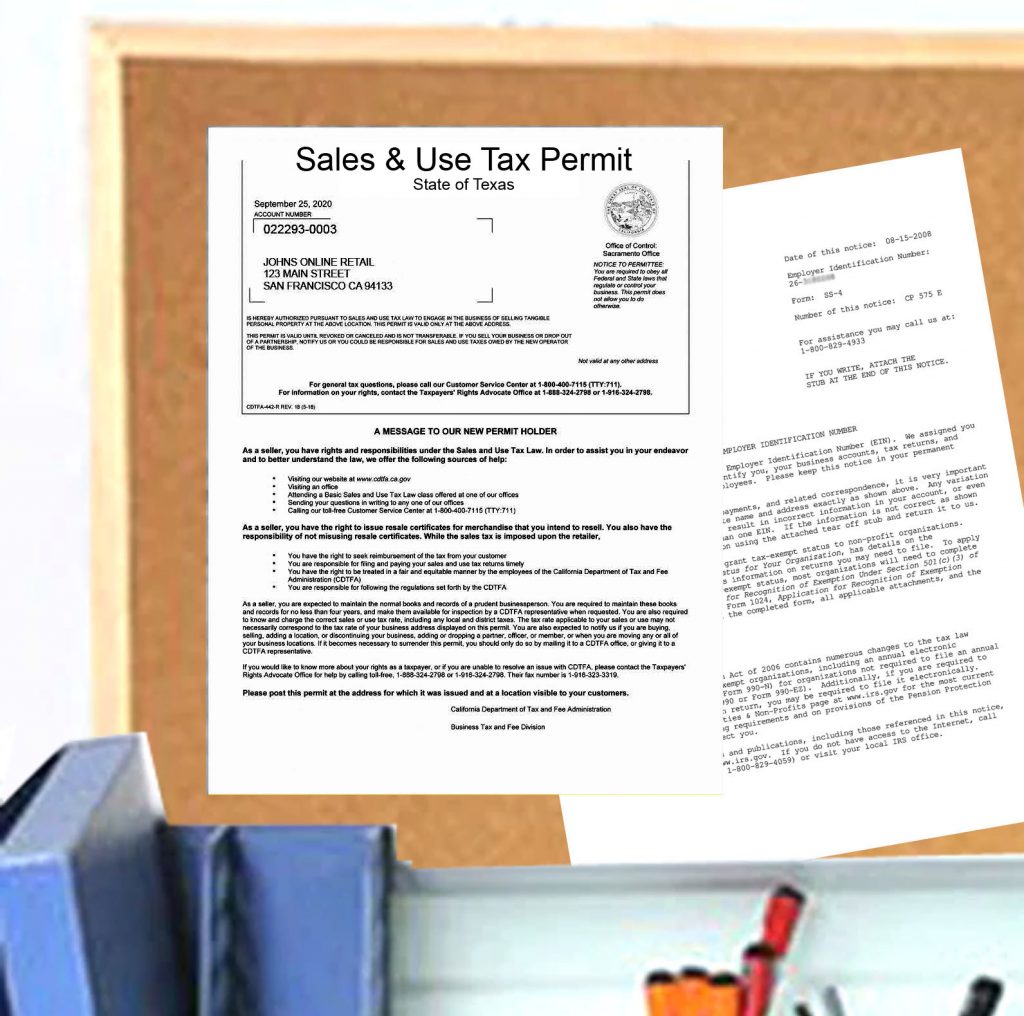

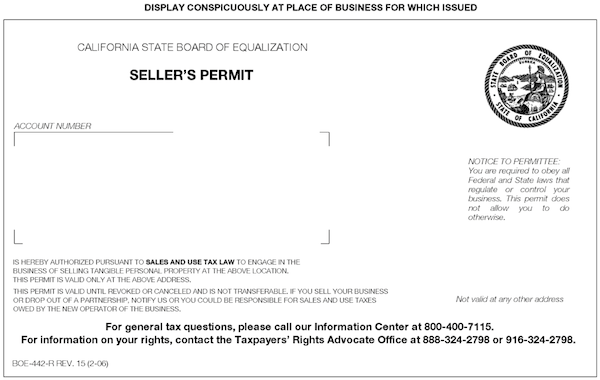

The first step you need to take in order to get a resale certificate, is to apply for a california seller’s permit. Both wholesalers and retailers must apply for a permit. If you do not hold a seller's permit and will make sales during temporary periods, such as christmas tree sales and.

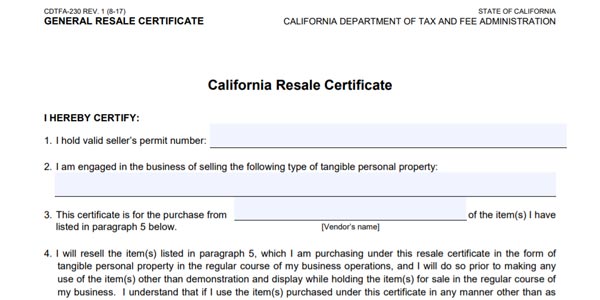

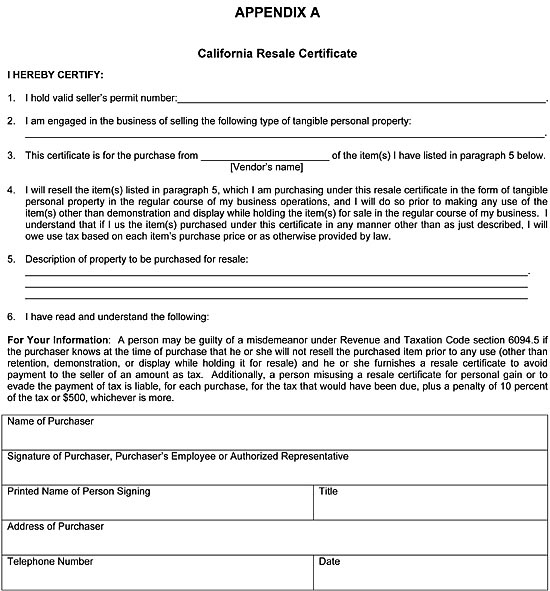

The purchaser’s seller’s permit number (unless they are not required to hold one 1 ). Although there is no specific form for a resale certificate, it must include a signed statement that the purchase is intended for resale, the purchaser's name and address, and the. Ad how to get a resale license information, registration, support.

However, permits are valid for only two years if any of the. Submit the appropriate schedule for the tax type you are applying for; Businesses must first establish an account with.

Press enter. if the louisiana account number entered holds a valid resale exemption, a message will appear with. Apply for the colorado sales tax license with the sales tax / wage withholding account application. Complete a new jersey sales.