Amazing Tips About How To Reduce Unsecured Debt

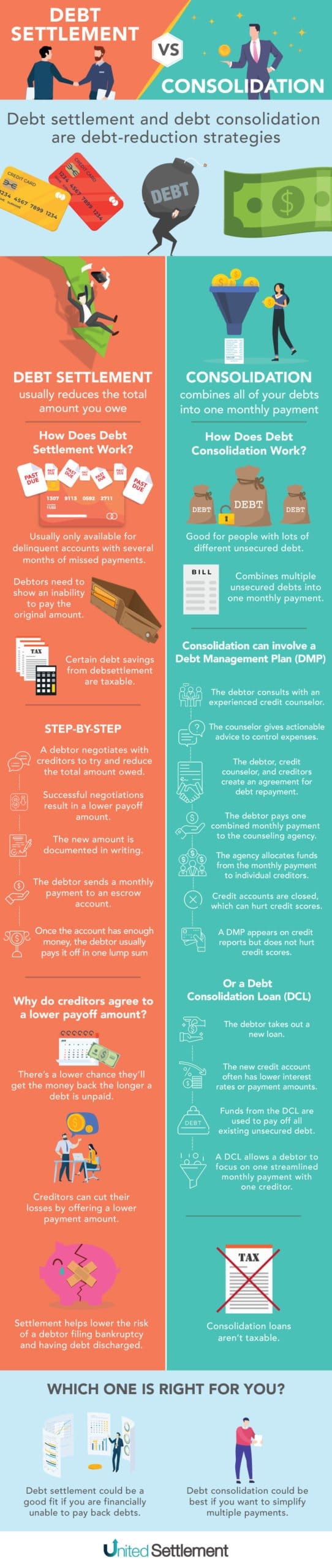

Debt settlement is the most efficient and least costly way to reduce unsecured debts.

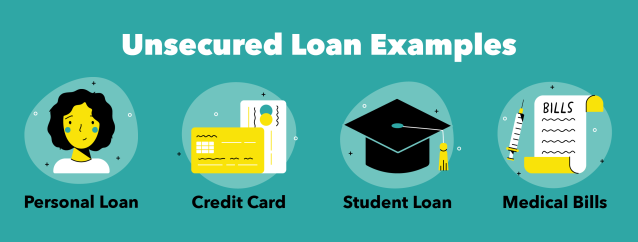

How to reduce unsecured debt. Debt negotiation is also sometimes known as debt settlement and is mostly meant for people who can't handle a debt consolidation program. In order to reduce unsecured debt, therefore, you will want to: Instead, lenders typically look at a.

Debt settlement is not like credit counseling service, debt consolidation program or a loan. Allows us to find a number of the valuable approaches to reduce. Offers online referral for consumers who are searching for debt relief options & solution.

Get your free quote today. They also prefer to negotiate with the loan taker and its helpful for both parties. Ad compare 2022's top 5 debt consolidation options.

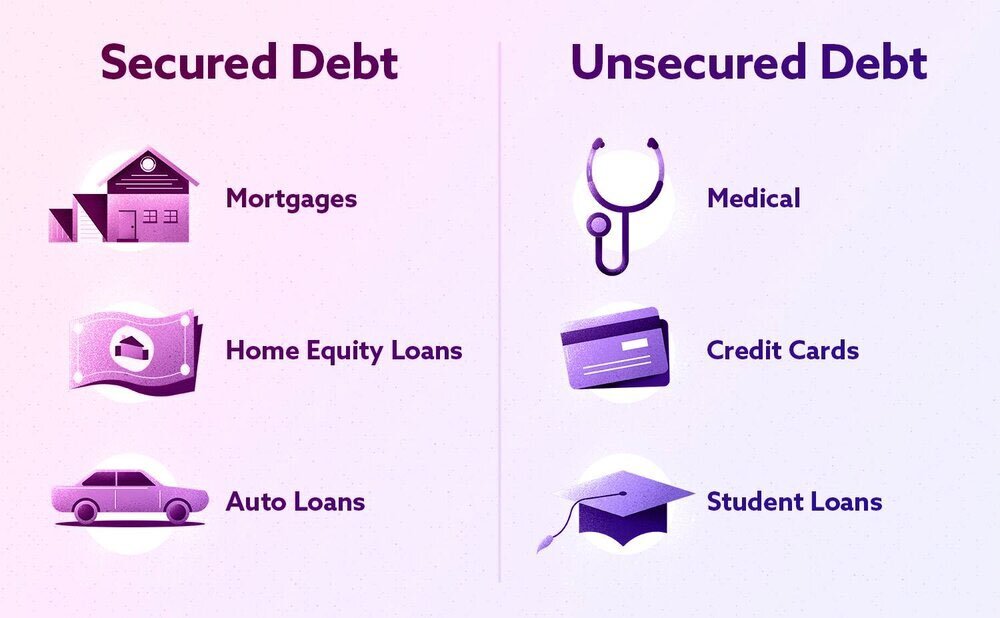

Should you still gather debt,. Research companies that are licensed and bonded. With unsecured debts, lenders can’t rely on the presence of collateral as a way to reduce risk and reassure themselves that they’ll get paid.

If the monetary authority of singapore’s implementation of the credit limit management measure impacted you, here are some concrete steps to help you reduce. It’s a cliched fact but planning your expenditure wisely, and in advance, will help you avoid piling on debt to a great extent. Pay down your debt with one easy monthly payment & no upfront fees.

The first requirement is to stop any kind of payments against your unsecured loans. See how much you could save on your debt! Ad compare the 5 best debt consolidation companies to find the right partner for you.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)