Breathtaking Info About How To Improve Financial Ratios

Ad small business accounting software designed for you.

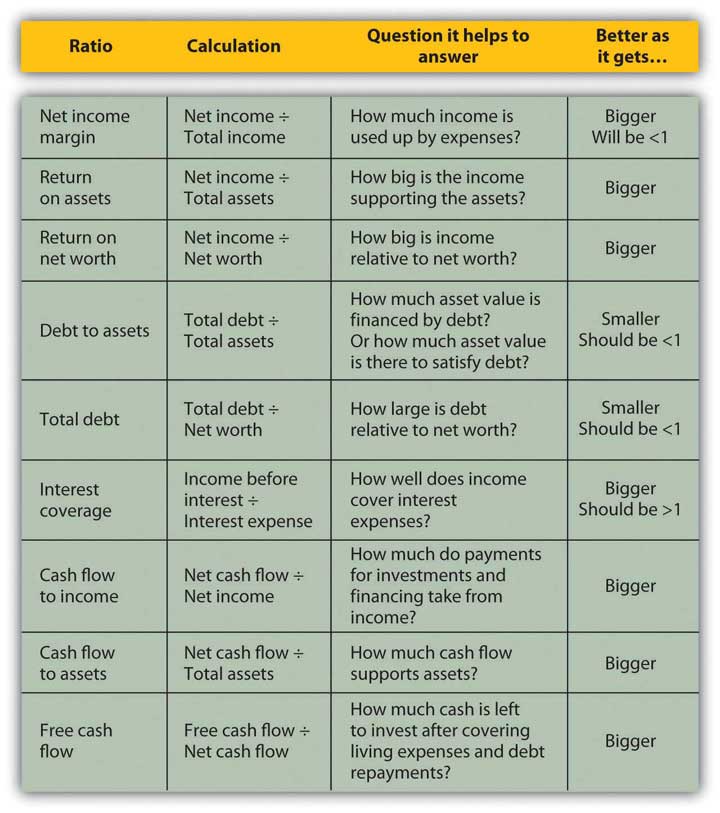

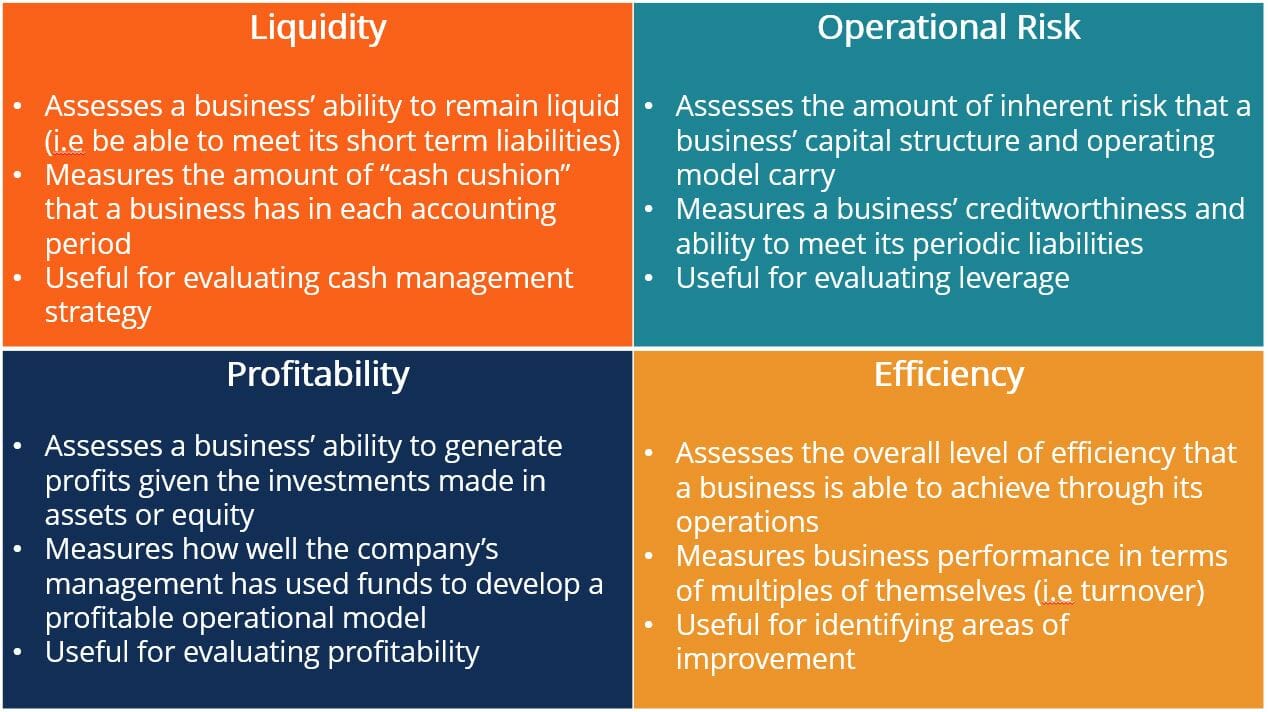

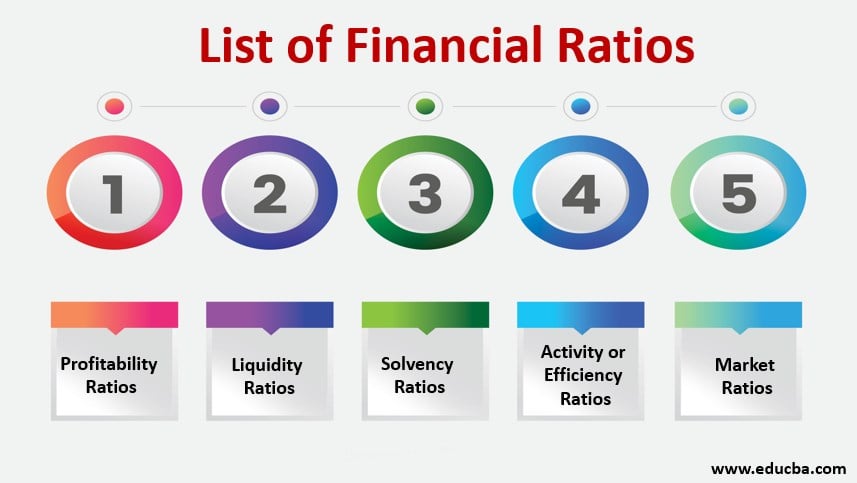

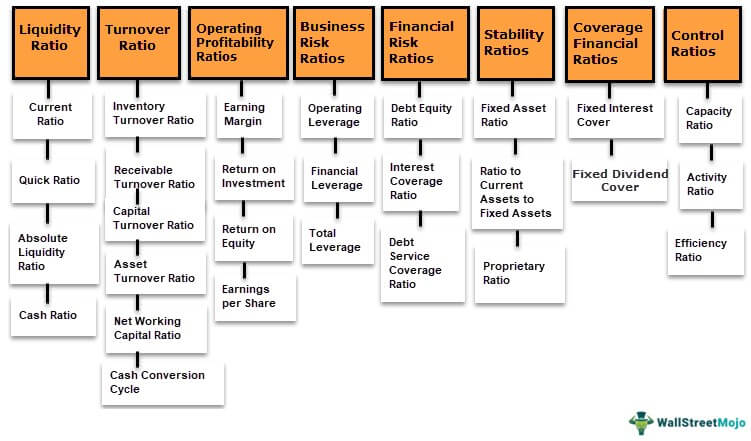

How to improve financial ratios. (s)olvency ratios, (p)rofitability ratios, (e)fficiency ratios, (l)iquidity ratios, and (l)everage ratios. Measures how much debt a business is carrying as compared to the amount invested by its owners. Ad wide range of investment choices, access to smart tools, objective research and more.

The more your accounts receivables increase and the faster you receive money for your sales, the better your. Ratios in each of these five categories provide a. Prepare in advance and take action early.

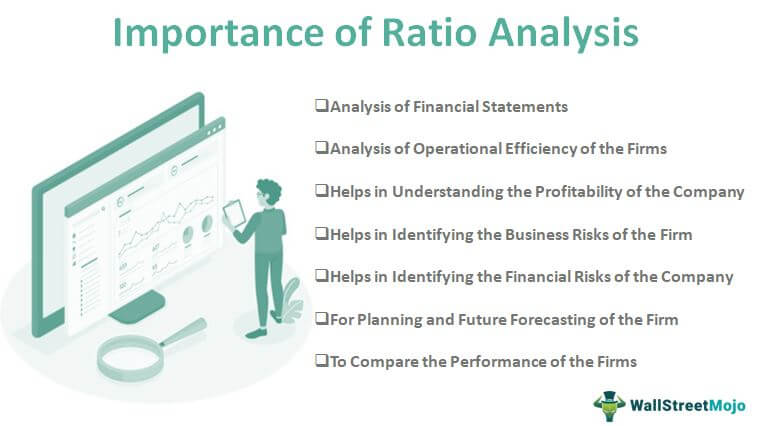

How to improve your financial efficiency improve collaboration between finance and the rest of the organization. The five categories of financial ratios include: If your ultimate focus is on profitability, we can help.

Here are five ways to improve your liquidity ratio if it's on the low side: Whatever your investing goals are, we have the tools to get you started. Teach your students the proven money and business principles for the real world.

The total debt ratio is calculated by dividing current liabilities over total assets (i.e., total liabilities ÷ total assets). Looking for a financial advisor? Its eps for the past 12 months averaged $5.

Ad build your future with a firm that has 85 years of investment experience. How to use financial ratios to improve your business leverage ratios. Ad when it comes to your financial future, we understand your interests, goals, and concerns.

/GettyImages-1085069872_journeycrop_financial_ratios-2beca482cffe497a97be706cc07a2124.jpg)