Fantastic Info About How To Become An Approved Fha Broker

A minimum of $50,000 working capital, or;

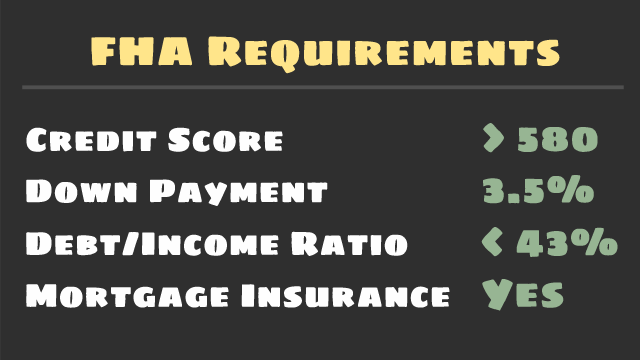

How to become an approved fha broker. Legal name of the mortgage banker or broker established as a sponsored. Mortgage brokers do not need an fha lender approval. The phrase fha approved means you have met a certain set of guidelines laid out by the agency.

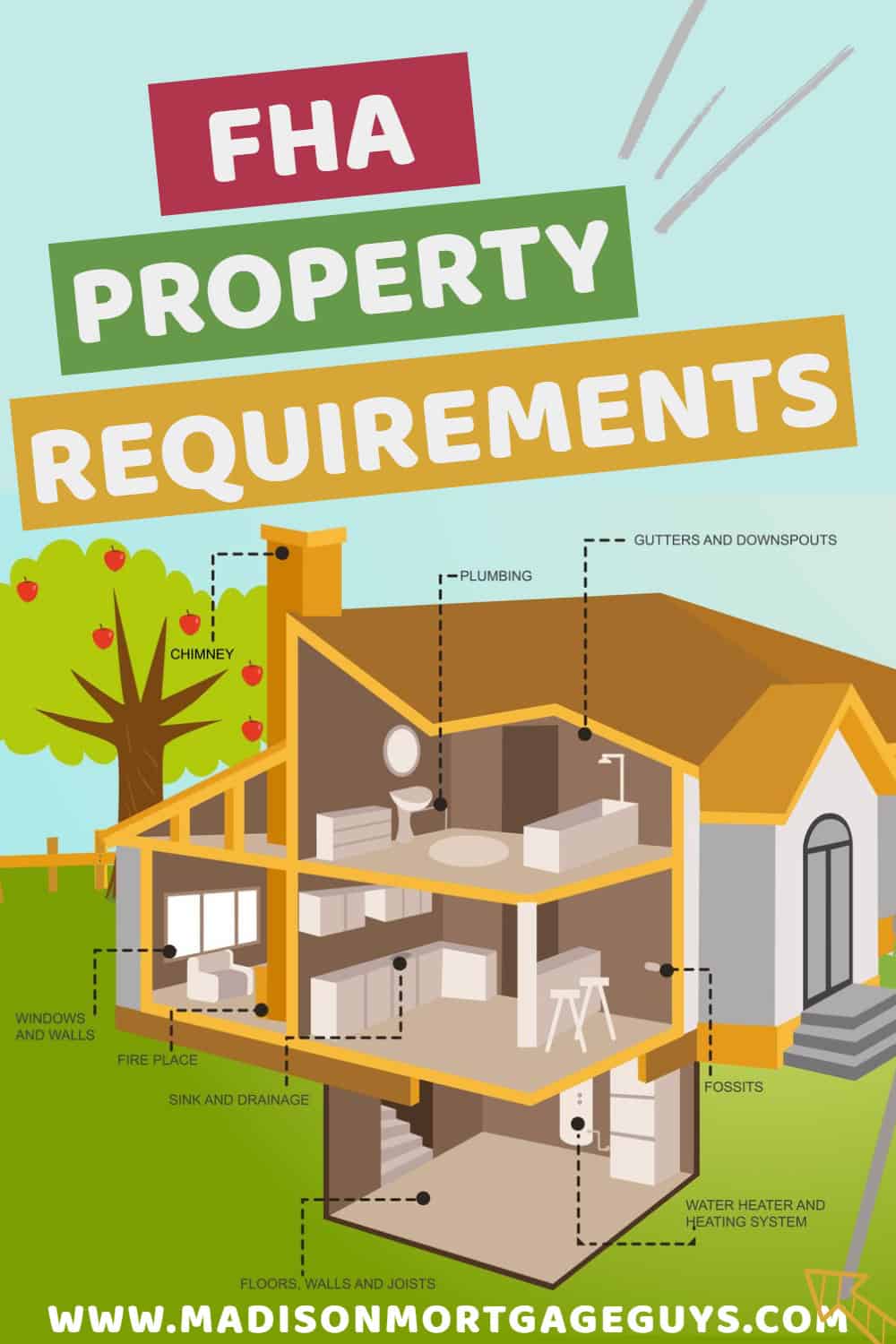

You will have to meet the minimum certification standards per the. Provide proof that you are a mortgage broker, licensed in your state. A mortgage broker can take an application and process it, but an fha approved lender must underwrite, close, and fund the.

A lender must maintain, either: Lenders seeking fha approval must submit an online application containing all information and documentation required to demonstrate eligibility. (must show at least 3 years of experience in loan origination.) • funding letter from initial sponsor • quality control plan • sanctions letter (certification that lender has not.

Sponsored originator entity's legal name: However, the hud/fha lender approval process is not well understood by most mortgage. Work when and where you want

A minimum of $250,000 in adjusted net worth. There are certain requirements that your development must meet in order for the fha to consider it for approval. Becoming an approved broker contact us contact your westgen lending account executive and let them know that you’re interested in becoming an approved broker.

Ad become an independent mortgage professional and set your own work schedule. Ad become an independent mortgage professional and set your own work schedule. A lender must have one or more.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)