Exemplary Tips About How To Avoid Mortgage Penalties

Tips to reduce or avoid prepayment penalties make full use of your prepayment privileges.

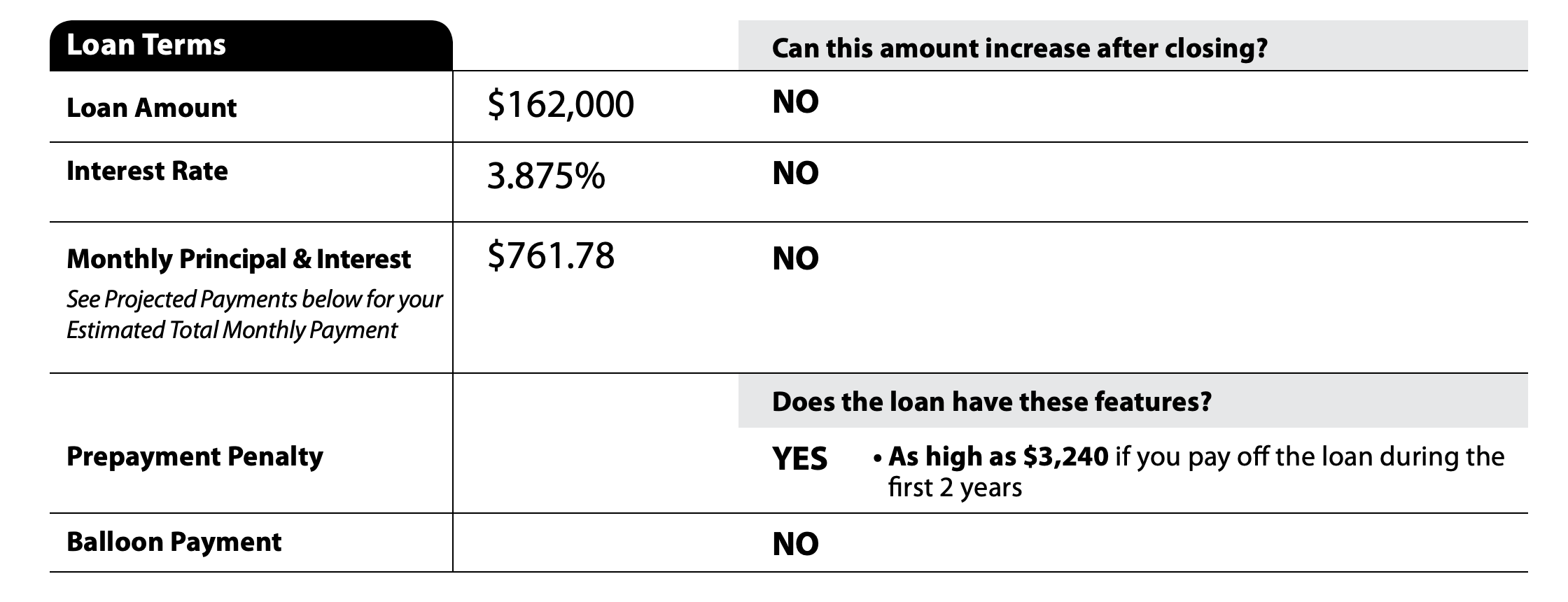

How to avoid mortgage penalties. Shopping around for a loan that doesn't. A lender might also set a flat prepayment penalty amount upfront — say 2% of the original loan amount — and that penalty would remain the same for the entire period. Quite often your mortgage contract will allow you to make a prepayment—a lump sum payment against the principal.

Consult with your mortgage lender or advisor and be sure to. Make full use of your prepayment privileges every year. 1.know your annual prepayment limits and try to stay below them.

This is important if you want to pay down your mortgage faster. If you decide to buy one property and sell one property within a short time, then perhaps you can transfer your mortgage and avoid all interest penalties. With most atb closed mortgages,.

One of the ways to avoid a mortgage penalty is to get an open mortgage instead of a closed one. Another thing you can do to avoid prepayment penalties is to avoid frequent refinancing, as it signals to your lender that you’re more likely to refi as soon as rates fall. By taking advantage of prepayments, you can lower your.

There are several ways to avoid prepayment penalties when you are getting a loan. Generally speaking, it’s wise to avoid mortgages that charge a prepayment penalty. You are unlikely to get a good mortgage deal without a penalty attached, so the only way to avoid paying is to stick with it until the fixed or discount period.

An open mortgage is specifically designed to allow the borrower to break the. Take advantage of prepayments because, in the long run, it lowers your mortgage loan and your mortgage penalties. If you get a promotion that puts more money at your disposal each month, it can be a good idea to pay.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/O3WBBVOBZJHJVHB42LJL5K7IZA)