Divine Tips About How To Avoid Exchange Rate Risk

No hedging, converting dm 3 million into.

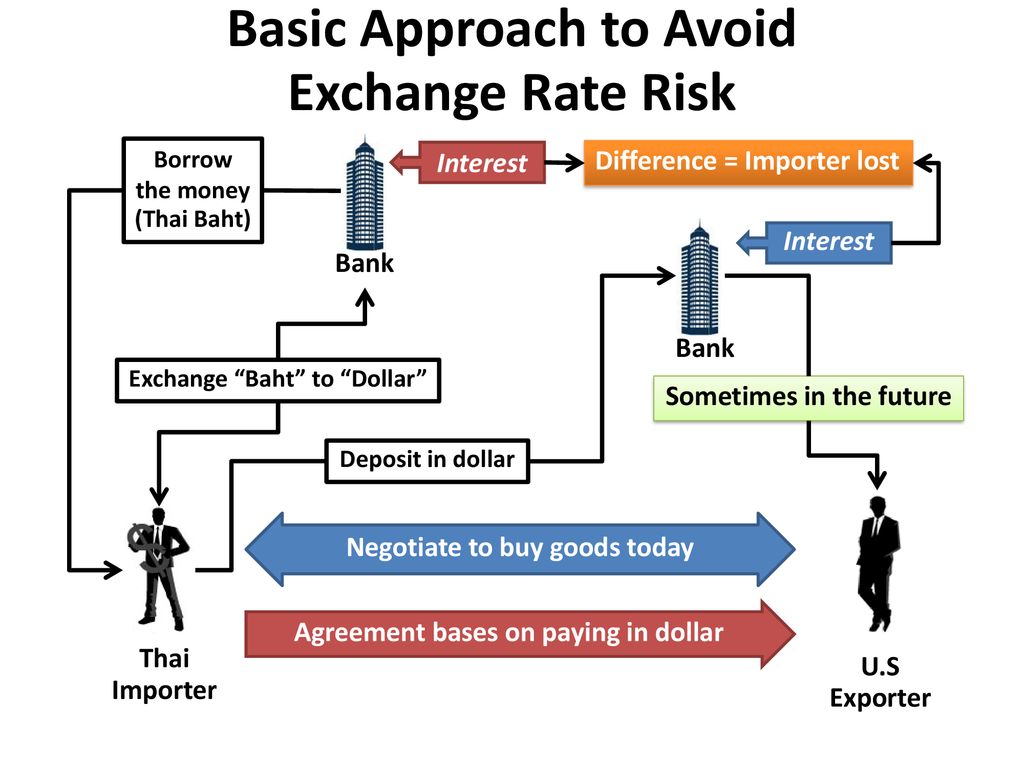

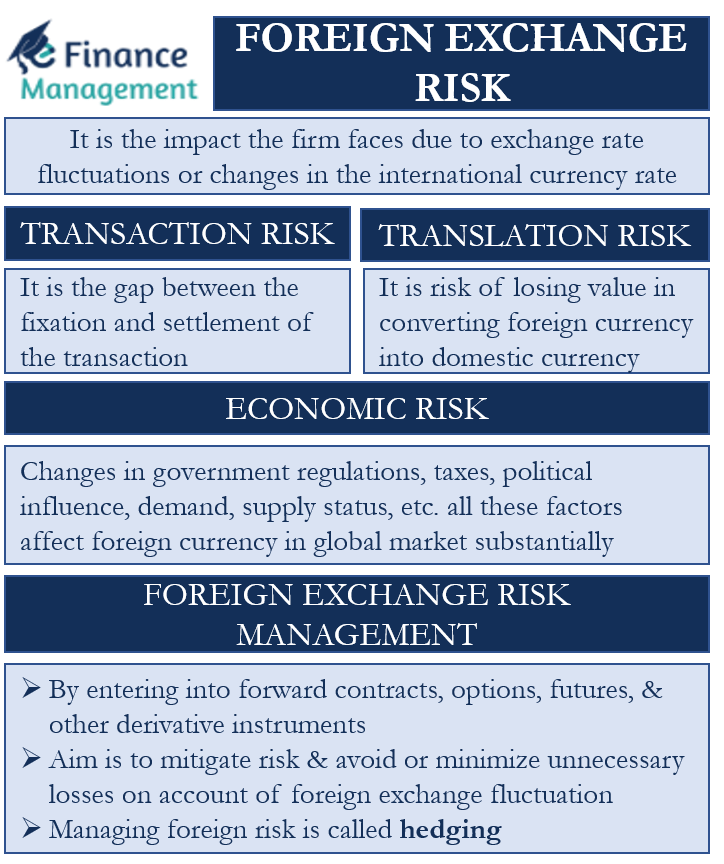

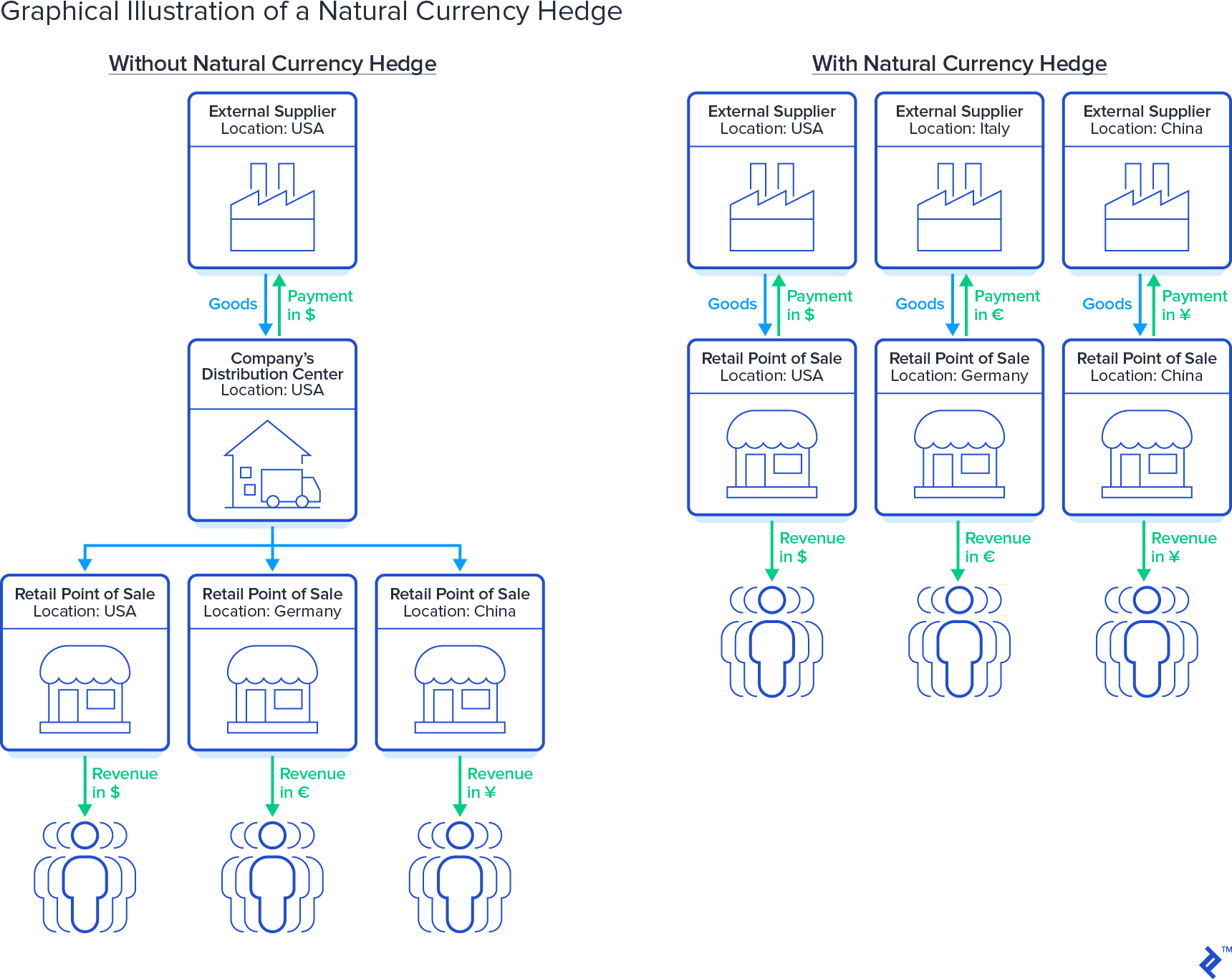

How to avoid exchange rate risk. In order to eliminate the currency exchange risk they can use a currency forward exchange contract. Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques. An etf comprises a collection of securities bundled together and.

For example, a business involved in raw material trading usually hedges close to 100 per cent of their. One of the simplest ways to avoid the risks associated with fluctuations in exchange rates is to quote prices and require payment in u.s. Unfortunately, there is no getting away from it:

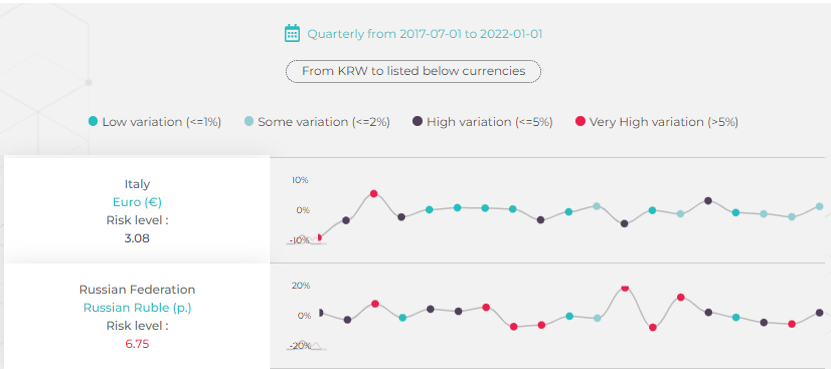

If you want to keep doing business internationally in the same way as you always have done, but with reduced exchange rate risk, you can consider using derivatives to hedge your exposure. In other words, the exchange rate between. The three types of foreign exchange risk include:

Transaction risk is when rates change before your transaction is finished. A forward contract gives the owner the obligation to buy or sell an. How to avoid exchange rate risk by elvis picardo, cfa | august 25, 2015 3:33 pm edt.

How to avoid foreign exchange risk. Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques. Weather events, like storms, flooding, and droughts.

Transaction risk is the risk faced by a company when making financial transactions between jurisdictions. You can now also invest in currency hedged funds, which build in the hedge to the holdings of the fund. Financial derivatives have a reputation for complexity—and sometimes that reputation can be justified.

/GettyImages-1197760630-5c570c2c43db4fe79d11563aa8cdd196.jpg)

/GettyImages-157380238-de8368377d114242af29d2d670382aa6.jpg)