Spectacular Tips About How To Avoid Corporation Tax

The sale of other goods or assets (chargeable gains) for.

How to avoid corporation tax. It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or. The unit owners of an llc or stockholders of a “c” corporation may be corporations or foreign citizens. Companies can benefit from the “ annual investment allowance ” (aia) which allows a business to claim immediate tax relief on purchases of certain business assets up to a specified limit.

For instance, if a company's net income is first. One of the easiest ways to reduce your corporation tax bill is to use the company profits to pay into your. Claim r d tax relief.

When logged in to your hmrc online account you can find your submitted. Have the target corporation convert to an s corporation to avoid a corporate level tax. When you sell a business or business assets at a profit, the irs expects to receive a cut in the form of capital gains tax.

Your company must continue to file a company tax return and pay corporation tax on taxable profits arising from: This will require the new converted s corporation to wait ten (10) years under current tax laws. If any date falls on a saturday, sunday or a legal federal holiday, the installment is due on the next regular.

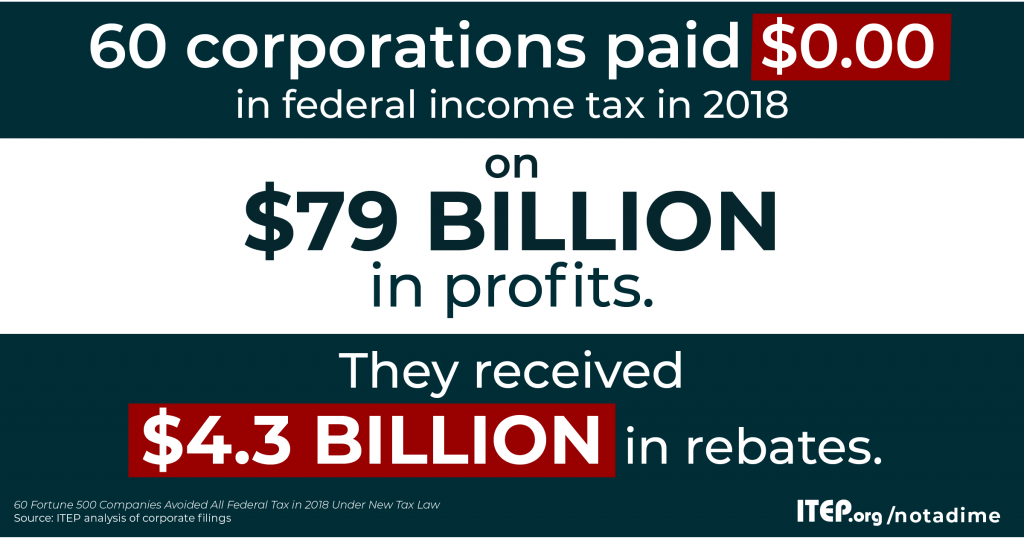

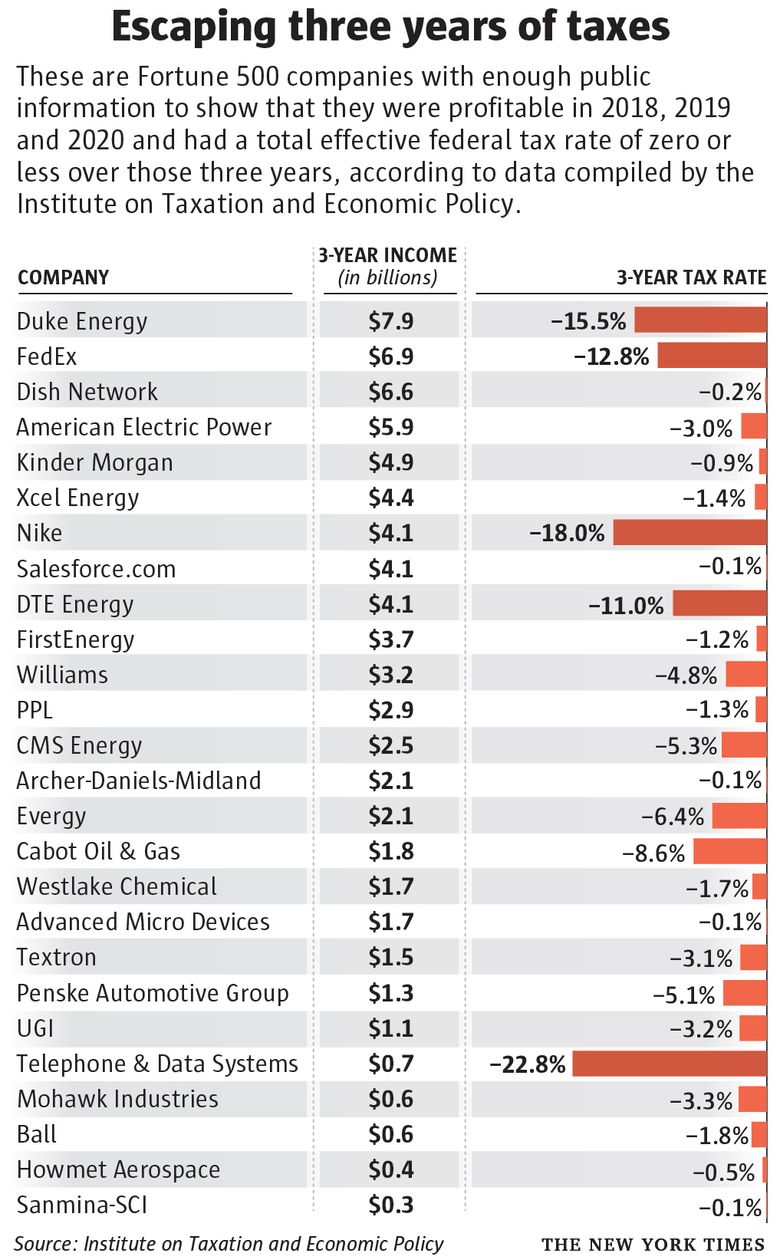

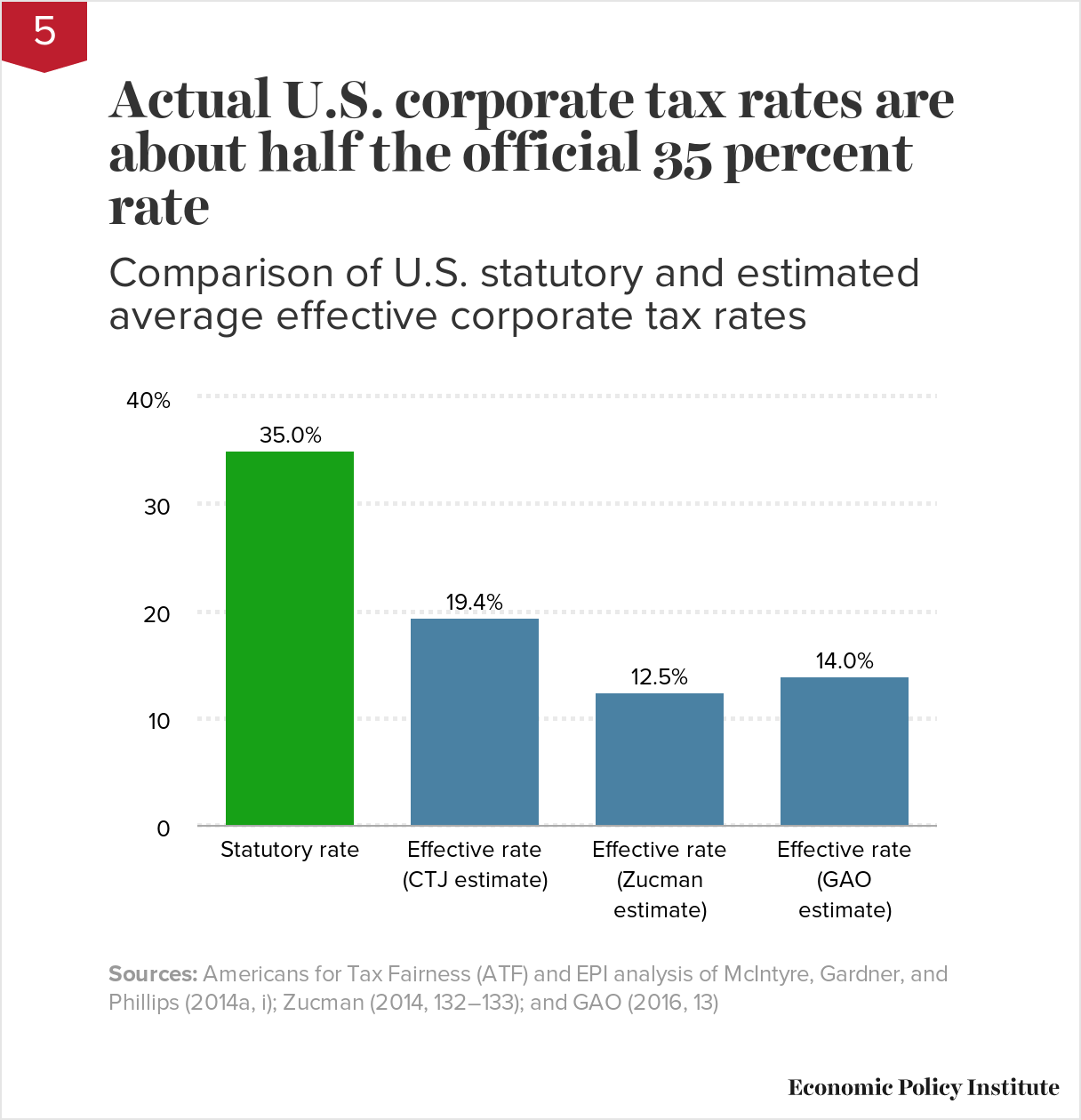

10 tips on how to avoid paying taxes tip #1: Another fortune 500 and other major companies avoid taxes is with accelerated depreciation. Llc tax benefits and “c” corporation tax benefits “c” corporations (i.e., general.

The internal revenue service (irs) allows for a variety. In this scenario, corporate earnings are taxed twice at two different points in time on the same stream of income. For help, see the file the estate income tax return.